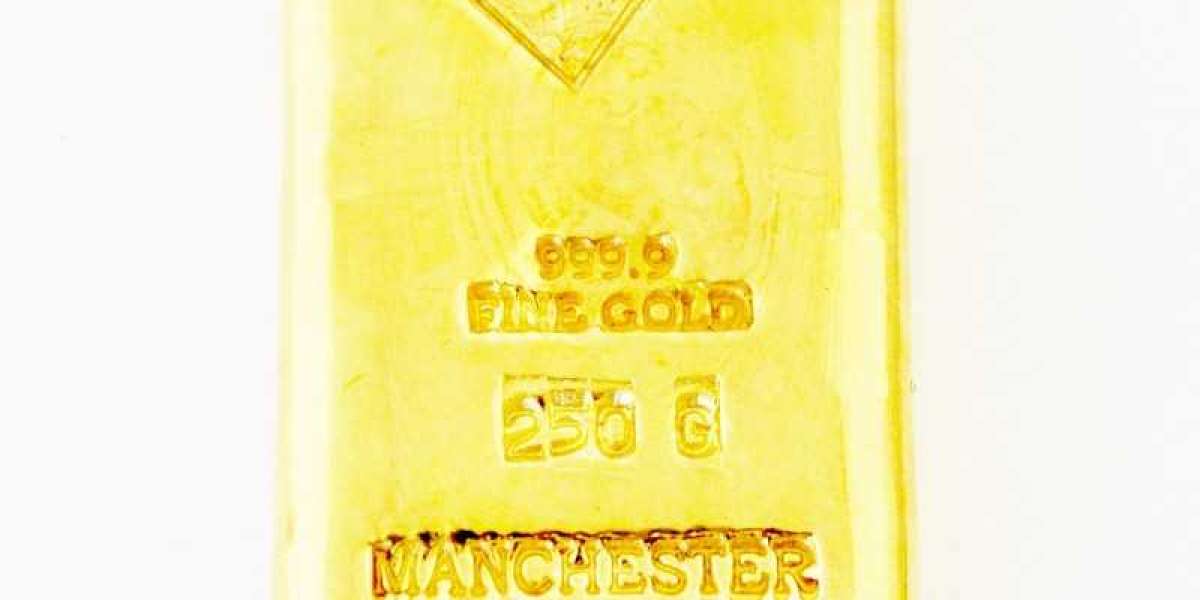

Investing in gold has long been considered a reliable gold bar 250g way to secure wealth and hedge against economic uncertainties. Among the various gold investment options, a 250g gold bar is a popular choice for both seasoned investors and newcomers. This article delves into the advantages, specifications, and considerations for purchasing a 250g gold bar.

Why Choose a 250g Gold Bar?

Gold bars are an efficient and cost-effective way to invest in gold. A 250g gold bar strikes a balance between affordability and substantial value. It is an ideal size for investors looking for significant gold holdings without the premium associated with smaller denominations.

Key Benefits:

Purity: Most 250g gold bars are refined to a purity of 99.99% (also known as 24-karat or fine gold), ensuring the highest quality.

Cost Efficiency: Compared to smaller gold bars or coins, a 250g gold bar typically carries a lower premium per gram.

Liquidity: The size and weight make it easy to store, transport, and sell when needed.

Diversification: A 250g gold bar helps diversify an investment portfolio, reducing overall risk.

Specifications of a 250g Gold Bar

Weight: 250 grams (8.0385 troy ounces)

Dimensions: Varies by manufacturer but generally compact for secure storage.

Purity: 99.99% fine gold (999.9).

Certification: Reputable bars come with an assay certificate verifying weight and purity.

Brands: Leading manufacturers like PAMP Suisse, Valcambi, and Heraeus produce high-quality 250g gold bars.

Where to Buy a 250g Gold Bar

When purchasing a 250g gold bar, it is crucial to buy from reputable dealers to ensure authenticity and quality. Some options include:

Authorized Dealers: Established precious metal dealers with a track record of reliability.

Banks: Some banks sell gold bars directly to customers.

Online Platforms: Trusted e-commerce platforms offer competitive pricing and secure delivery.

Auctions and Exchanges: Specialized gold exchanges and auctions can also be a source, but ensure thorough verification.

Pricing and Premiums

The price of a 250g gold bar depends on the current spot price of gold and the premium charged by the dealer. Premiums are influenced by factors like:

Manufacturer’s reputation

Production and refining costs

Market demand

Shipping and insurance costs

To get the best value, compare prices from multiple sources and consider buying during market dips.

Storage and Security

Proper storage is essential to protect your investment. Options include:

Home Safes: A secure and fireproof safe gold bar 250g for storing gold at home.

Bank Vaults: Deposit your gold in a bank’s safety deposit box.

Specialized Facilities: Companies offering insured vault services designed for precious metals.

Selling a 250g Gold Bar

When it’s time to sell, ensure you:

Approach reputable dealers or refineries.

Verify current market prices.

Retain all original certificates and packaging for better resale value.

Conclusion

A 250g gold bar is an excellent investment for those seeking to preserve wealth and diversify their financial portfolio. With its high purity, cost efficiency, and liquidity, it remains a preferred choice among investors worldwide. Whether you’re a first-time buyer or a seasoned investor, the 250g gold bar is a solid step toward securing your financial future.